Delving into the realm of Property Management for high-net-worth individuals opens up a world of exclusive services and tailored experiences. This niche sector caters to the unique needs and desires of affluent clients, offering a glimpse into a luxurious lifestyle intertwined with property ownership.

As we explore the specialized services, investment strategies, and estate planning considerations for high-net-worth individuals, a comprehensive understanding of this fascinating domain will be unveiled.

Understanding High-Net-Worth Individuals

High-net-worth individuals are those who possess significant financial assets and wealth, typically exceeding a certain threshold. In the context of property management, these individuals have specific needs and expectations that set them apart from the average property owner.

Unique Needs and Expectations

High-net-worth individuals often require a higher level of service and attention to detail when it comes to property management. They expect personalized services that cater to their unique preferences and lifestyle. This may include exclusive access to luxury amenities, custom interior design services, and top-notch security measures to ensure their privacy and safety.

Importance of Personalized Services

Providing personalized services for high-net-worth clients is crucial in the world of property management. These individuals have high standards and expect nothing but the best when it comes to managing their properties. Tailoring services to meet their specific requirements not only enhances their overall experience but also helps build long-lasting relationships based on trust and satisfaction.

Specialized Property Management Services

When it comes to catering to high-net-worth individuals, property management services go above and beyond to provide a personalized and luxurious experience. These specialized services are designed to meet the unique needs and preferences of affluent clients, ensuring their properties are well-maintained and their lifestyle is seamlessly integrated into their living spaces.

Luxury Amenities and Services

- Concierge Services: Offering personalized assistance with reservations, event planning, and other concierge services to enhance the lifestyle of high-net-worth individuals.

- Private Chef and Catering: Providing access to top-tier culinary professionals to create gourmet dining experiences in the comfort of their own homes.

- Spa and Wellness Facilities: Incorporating state-of-the-art spa facilities, fitness centers, and wellness programs to promote health and relaxation.

- Landscape Design and Maintenance: Ensuring impeccable outdoor spaces with custom landscaping designs and expert maintenance services.

Utilization of Technology

Technology plays a crucial role in enhancing property management services for high-net-worth clients, providing convenience, security, and efficiency. Examples of how technology is utilized include:

- Smart Home Automation: Implementing smart home systems for personalized control of lighting, temperature, security, and entertainment systems.

- Virtual Reality Tours: Offering virtual tours of properties for remote viewing, allowing clients to explore homes in detail from anywhere in the world.

- Online Portal Access: Providing online portals for clients to access property information, maintenance requests, and financial reports in real-time.

- Security Systems: Installing advanced security systems with surveillance cameras, access control, and monitoring capabilities for enhanced safety and peace of mind.

Property Investment Strategies for High-Net-Worth Individuals

Investing in real estate can be a lucrative venture for high-net-worth individuals looking to diversify their portfolios and generate passive income. There are various investment strategies tailored to meet the specific needs and goals of high-net-worth clients. Understanding these strategies is crucial to making informed decisions and maximizing returns.

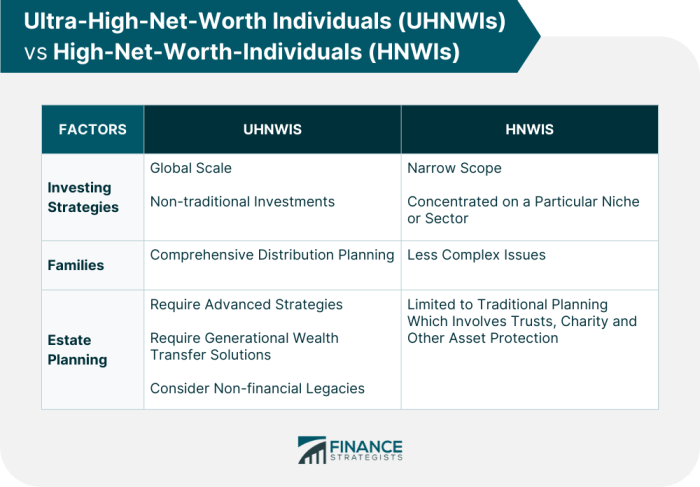

Traditional Real Estate Investments vs. Innovative Approaches

When it comes to property investment, high-net-worth individuals have the option to pursue traditional real estate investments or explore innovative approaches that may offer higher returns or unique opportunities. Let's compare these two approaches:

- Traditional Real Estate Investments:

- Buying and holding residential or commercial properties for rental income.

- Flipping properties for a quick profit.

- Investing in real estate investment trusts (REITs) for diversification.

- Innovative Approaches:

- Investing in real estate crowdfunding platforms for access to high-end properties with lower capital requirements.

- Exploring opportunities in emerging markets or niche sectors like luxury vacation rentals or sustainable properties.

- Utilizing technology and data analytics for smarter property investments.

Risk Management in Property Investment Strategies

Risk management plays a crucial role in property investment strategies for high-net-worth individuals, as they seek to protect their wealth and mitigate potential losses. Here are key considerations for risk management:

- Diversification: Spreading investments across different types of properties or geographic locations to reduce risk.

- Due Diligence: Conducting thorough research and analysis before making investment decisions to minimize unforeseen risks.

- Insurance: Securing adequate insurance coverage for properties to protect against unexpected events like natural disasters or liability claims.

- Professional Advice: Consulting with real estate experts, financial advisors, and legal counsel to ensure informed decision-making and risk mitigation.

Estate Planning and Wealth Management

Estate planning and wealth management play a crucial role in the financial strategy of high-net-worth individuals. It involves planning for the transfer of assets, including properties, to heirs and beneficiaries in a tax-efficient manner.

Connection between Property Management and Estate Planning

Property management is closely linked to estate planning for high-net-worth individuals as it ensures that properties are well-maintained and optimized for future generations. By effectively managing properties, individuals can maximize their value and ensure a smooth transfer of assets to heirs.

- Property valuation: Regular property valuations are essential for estate planning purposes to determine the overall worth of the property portfolio.

- Asset protection: Property management helps in safeguarding assets against potential risks and liabilities, ensuring that the wealth is preserved for future generations.

- Succession planning: Proper property management allows for the seamless transfer of properties to heirs according to the wishes Artikeld in the estate plan.

Integration of Property Assets into Wealth Management Strategy

Property assets are integrated into the overall wealth management strategy of high-net-worth clients to diversify their investment portfolio and mitigate risks. By including properties in their wealth management plan, individuals can benefit from potential rental income, capital appreciation, and tax advantages.

Tax implications and financial considerations related to property ownership for high-net-worth individuals need to be carefully evaluated to maximize wealth preservation and minimize tax liabilities.

- Diversification: Property assets provide diversification to the investment portfolio, reducing overall risk exposure and enhancing long-term returns.

- Rental income: Properties can generate rental income, adding a steady cash flow stream to the overall wealth management strategy.

- Capital appreciation: Real estate investments have the potential for capital appreciation over time, increasing the overall net worth of high-net-worth individuals.

Final Conclusion

In conclusion, Property Management for high-net-worth individuals goes beyond traditional real estate services, delving into a realm where opulence meets innovation. By blending personalized attention, cutting-edge technology, and strategic investment planning, this sector caters to the elite in a sophisticated and unparalleled manner.

Question & Answer Hub

How are high-net-worth individuals defined in property management?

High-net-worth individuals are typically classified as those with assets exceeding a certain threshold, often in the millions, and have unique requirements for property management services.

What are some specialized services offered for high-net-worth individuals in property management?

Specialized services may include personalized concierge services, exclusive property maintenance programs, and customized security measures to cater to the affluent clientele.

How can property assets be integrated into wealth management strategies for high-net-worth individuals?

Property assets can be strategically leveraged to diversify investment portfolios, enhance overall wealth growth, and contribute to long-term financial planning for high-net-worth individuals.